Is enough being done to educate young people about finances

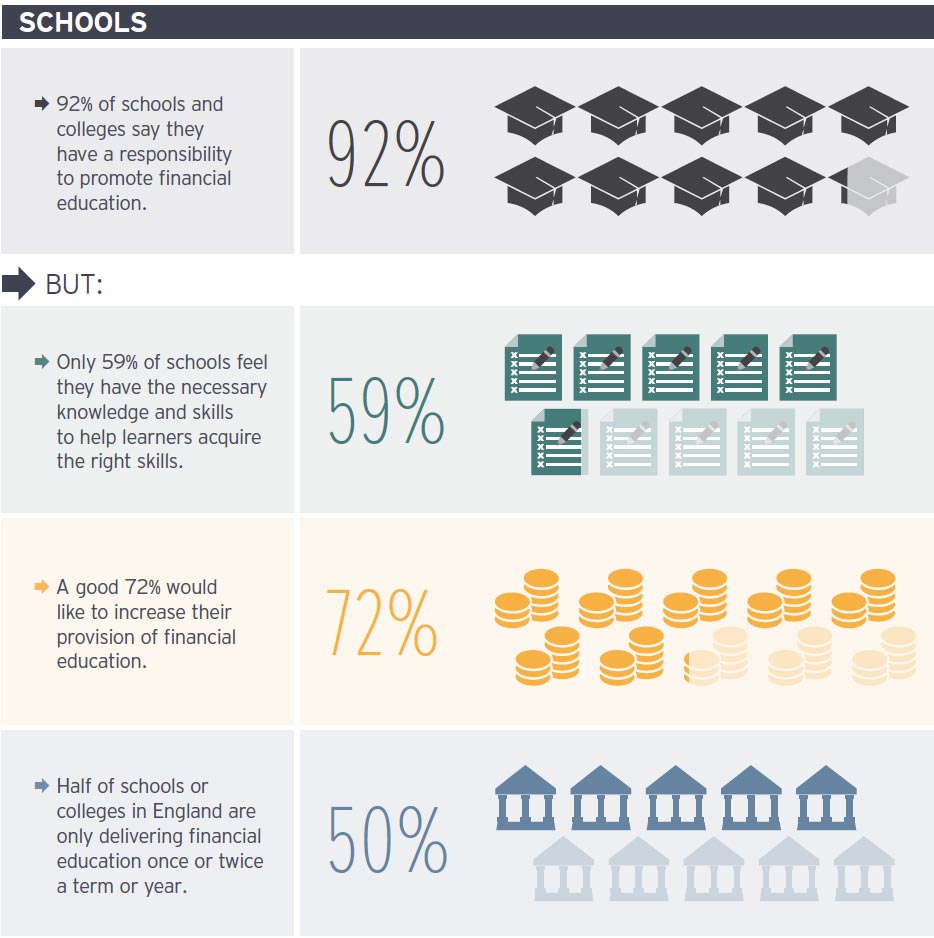

In the UK, financial education doesn’t have an established presence in schools or colleges, despite London itself being the second largest financial centre in the world. As young people consider themselves the least confident and knowledgeable about financial matters, who is going to bridge this knowledge gap? Here we look at what financial education is being delivered in schools and how financial advisers help promote it.

Children lack the financial vocabulary to even understand what’s important to them and this is not me being patronising, it’s the same thing as if somebody’s used to listening to classic music their whole life and suddenly, they get interested in punk rock.

Amyr Rocha-Lima

Chartered financial planner, Holland Hahn & Wills

We’ve worked with the Personal Finance Society and the Discover Fortunes and Discover Risk programmes to go in and start talking about some of the financial planning issues that matter and some schools are really taking an active part in educating and bringing in people to help, but generally, certainly when we’ve been in some schools, the level of education has been low.

Phil Patient

Phil Patient

Group Chief Operating Officer at HFMC Wealth

Part of our “do well do good“ as a business is, every year we send 30 pupils in our local schools through a financial education programme run by the London Institute of Banking & Finance and we love it, but the challenge that the schools have is that it’s part of the PSHE curriculum. It’s not given enough time or focus as a subject individually. It’s lumped in with sexual education and with social education and there’s no budget for it. So, schools have always got that challenge of both time and money to educate financially in a good way.

Chris Daems